Pay Data Import

Overview

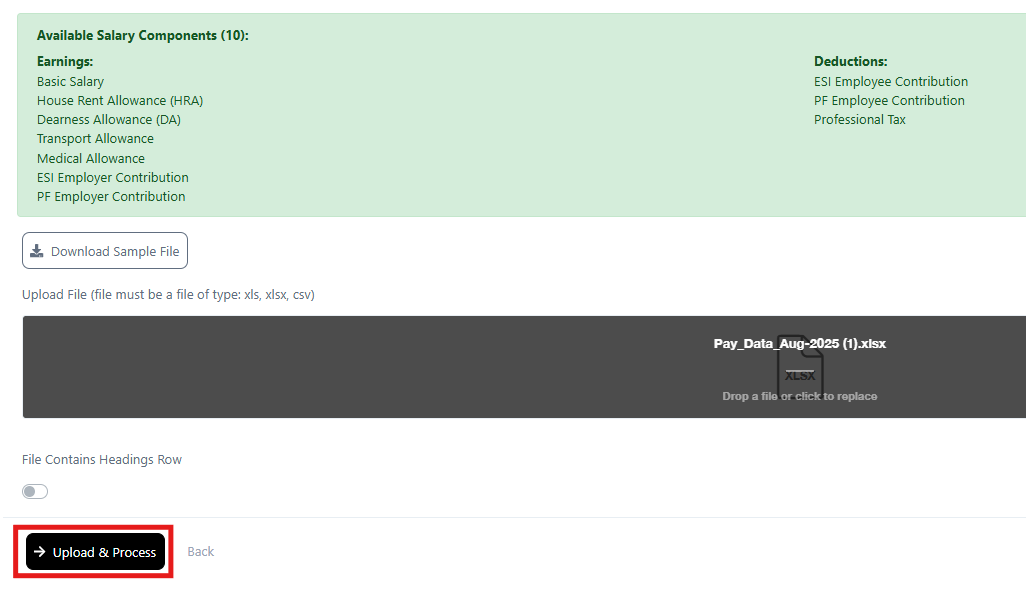

The Pay Data Import feature allows you to upload salary-related information for employees in bulk. Instead of entering each employee’s salary, allowances, deductions, and tax details manually, you can prepare the data in a structured Excel file and import it directly into CrmLeaf. This makes payroll processing faster, more accurate, and consistent.

Steps:

- Login to your CrmLeaf account.

- From the main menu, go to HRMS → Import Payroll.

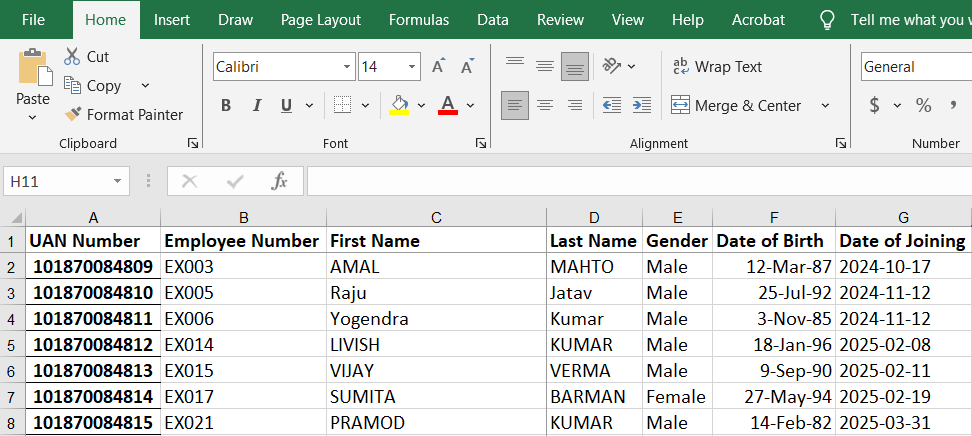

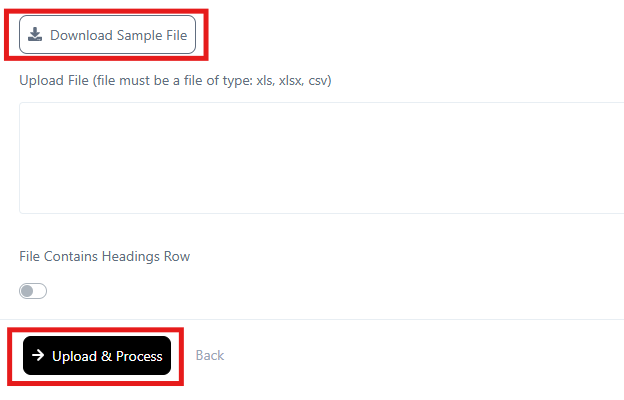

- On the Import Payroll page, click Download Sample File.

- The file contains predefined column headers required by CrmLeaf (such as Employee ID, Basic Salary, Allowances, Deductions, and Tax).

- Using this format ensures that your data matches the system requirements.

- Then click on Choose a file → select the xls file → then click Upload and Process

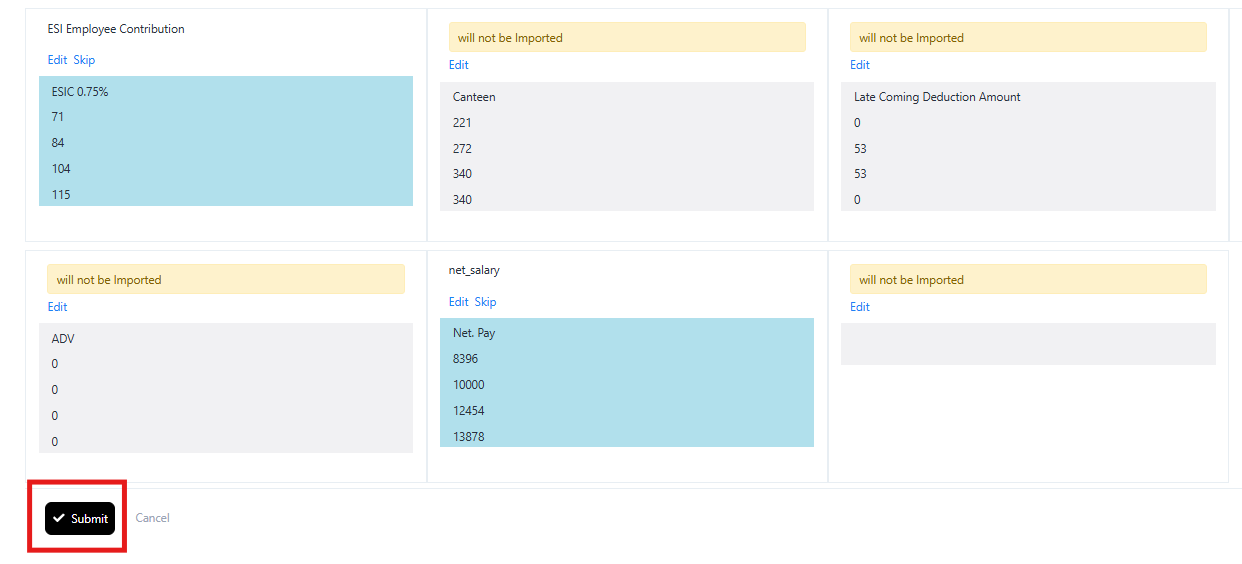

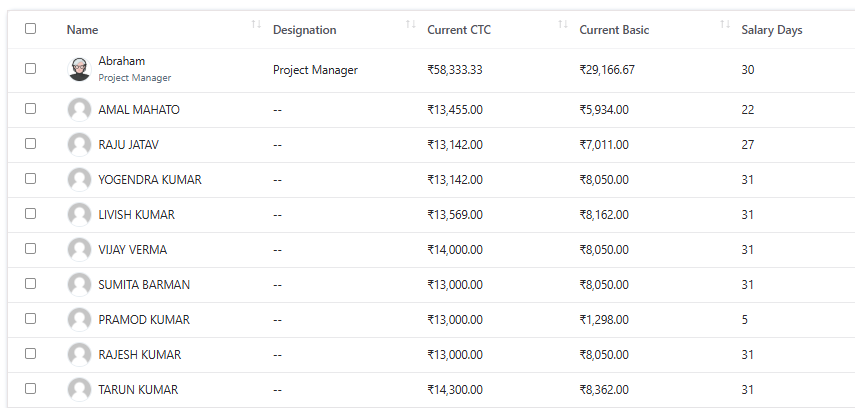

- In the next page you need to map the field with the data.

- Review the file carefully to ensure calculations and values are correct.

Generate Payroll Reports

Log in to your CRMLeaf account.

From the main menu, go to HRMS → Payroll Report

Here you can download the following reports

- Salary register

- Pay Summary

- PF Statement

- Attendance Summary

- Overtime Payment

- Bank Statement

- Salary Certificate

- Pay Difference Statement

- TDS Deduction

- ESI Deduction

-

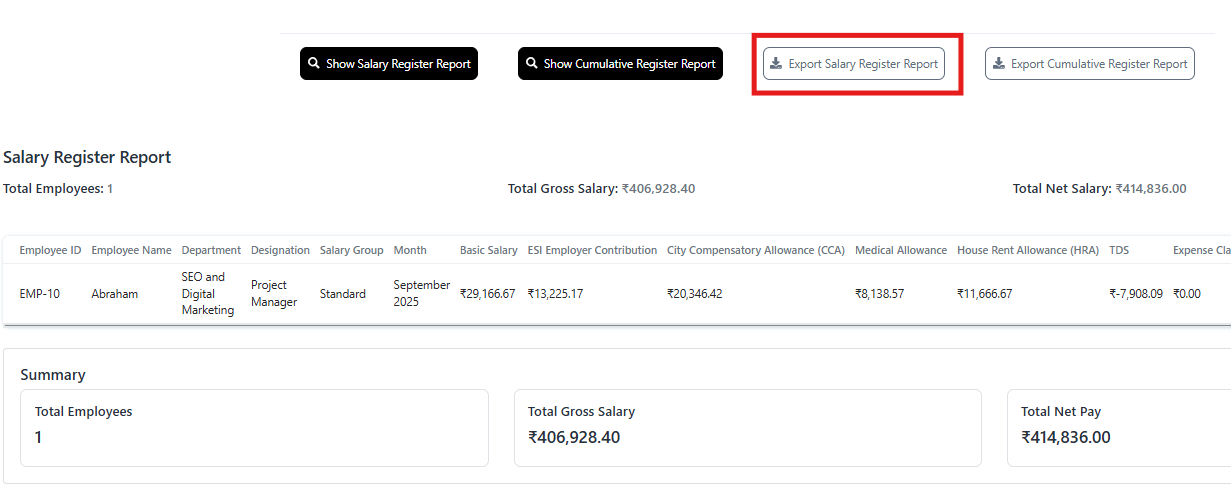

Salary Register

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on Salary Register → click on Export Salary Register Report

-

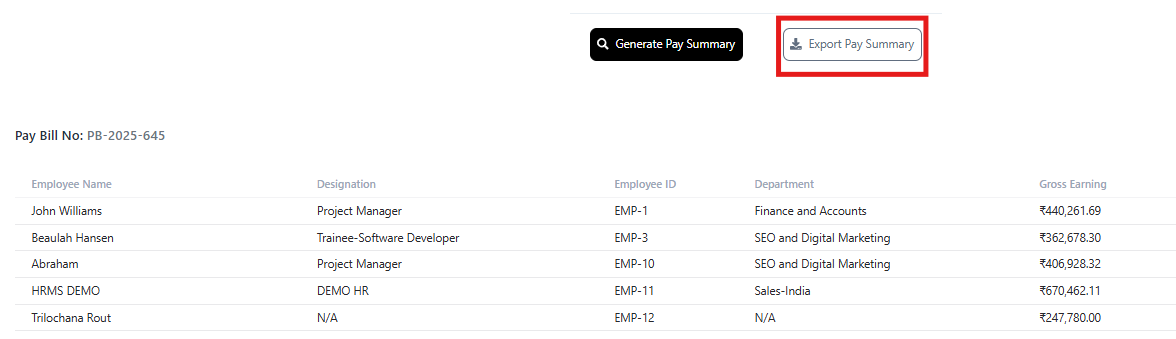

Pay Summary

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on Pay Summary → click on Export Pay Summary

-

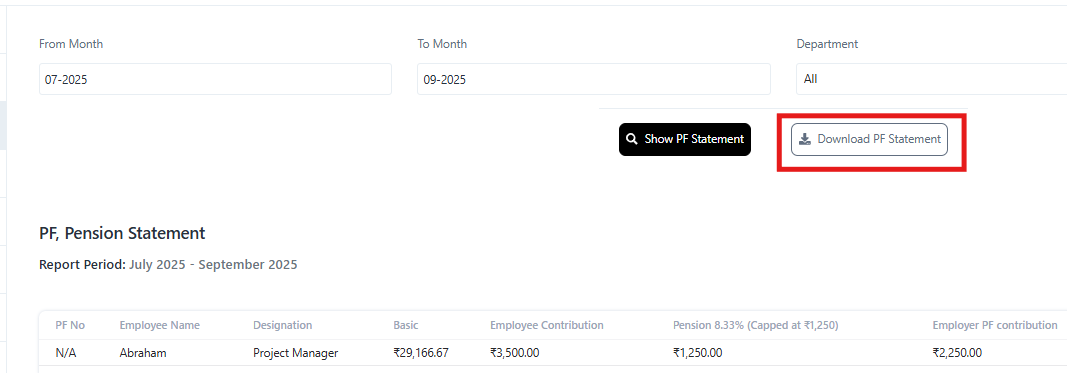

PF Statement

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on PF Statement → click on Download PF Statement

-

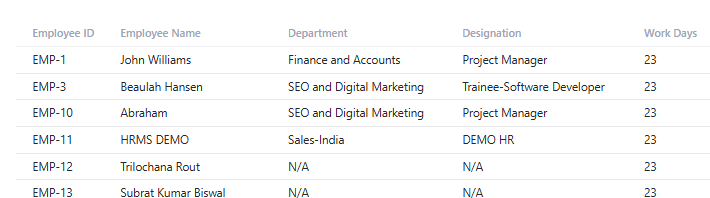

Attendance Summary

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on Attendance Summary → click on Export Attendance Summary

-

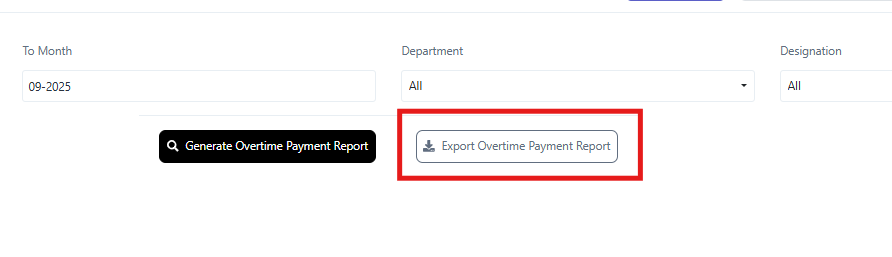

Overtime Payment

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on Overtime Payment → click on Export Overtime Payment Report

-

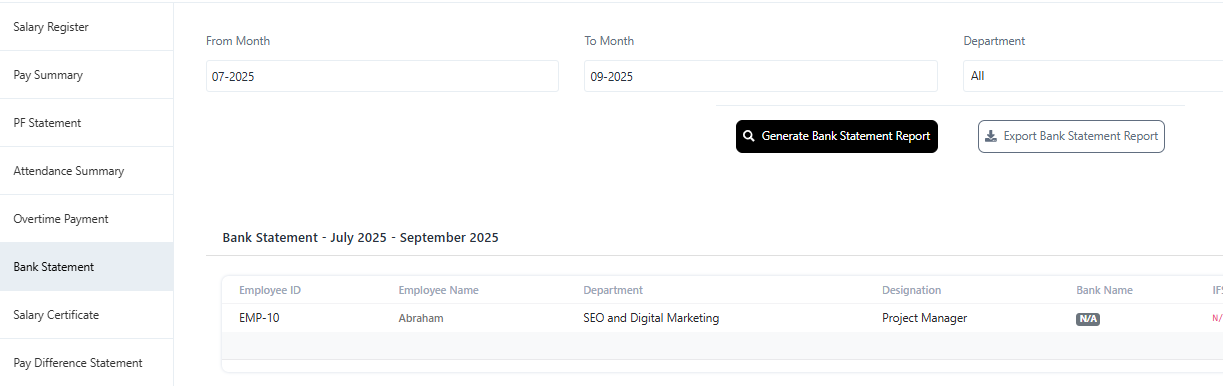

Bank Statement

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on Bank Statement → click on Export Bank Statement Report

-

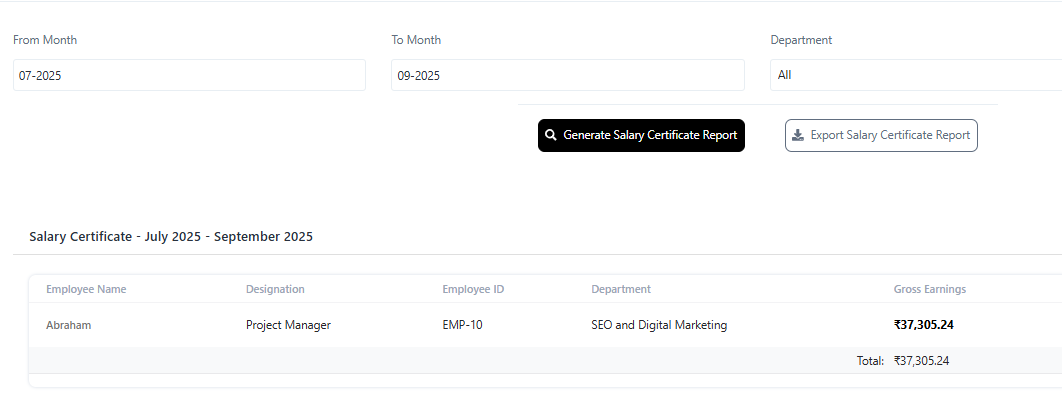

Salary Certificate

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on Salary Certificate → click on Export Salary Certificate Report

-

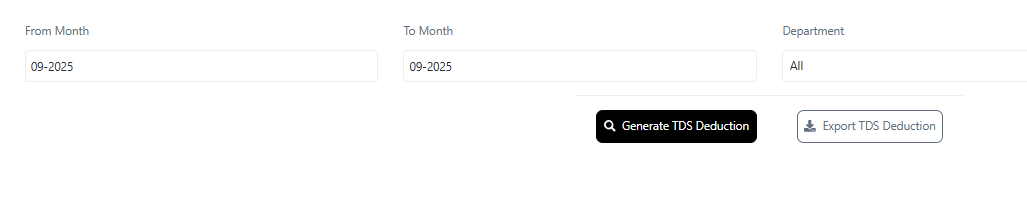

TDS Deduction

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on TDS Deduction → click on Export TDS Deduction

-

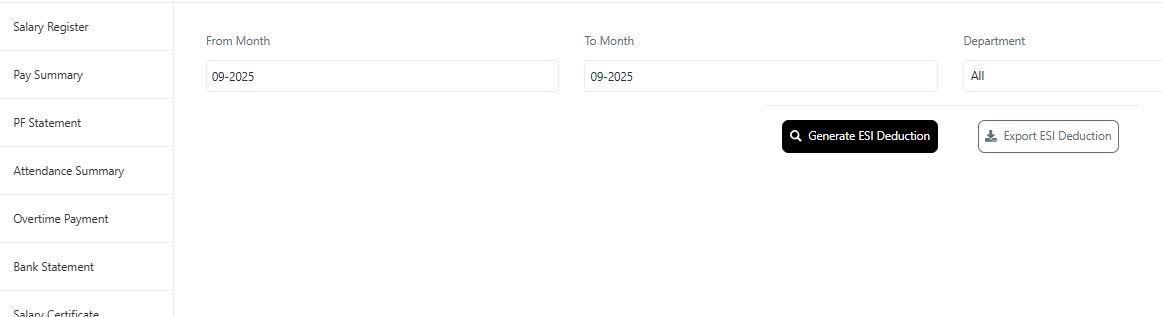

ESI Deduction

Navigate to the menu → Click HRMS → Click Payroll Report

Navigate to the left side of Payroll Report → click on ESI Deduction → click on Export ESI Deduction

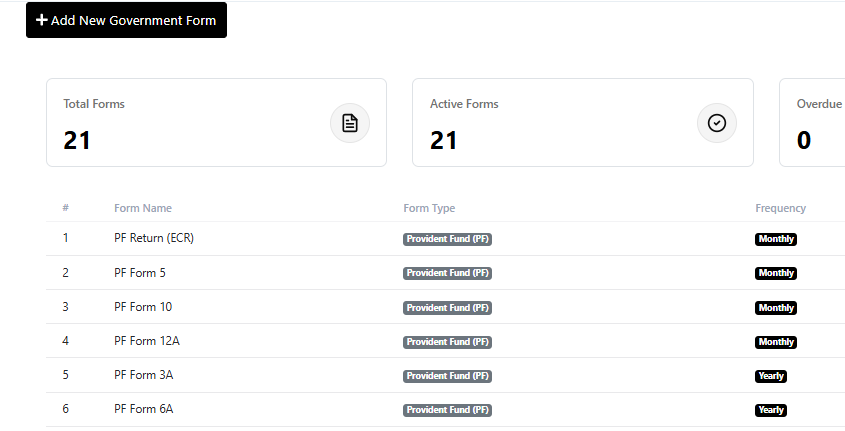

Statutory Filings & Returns

Login to your CrmLeaf account.

From the main menu, go to HRMS → Statutory Filings & Returns

Here you can download the following reports

- PF Return (ECR)

- PF Form 5

- PF Form 10

- PF Form 12A

- PF Form 3A (Monthly)

- PF Form 6A (Annual)

- ESI Return

- TDS Return (24Q)

- Professional Tax Return

- LWF Return

- Government Forms

-

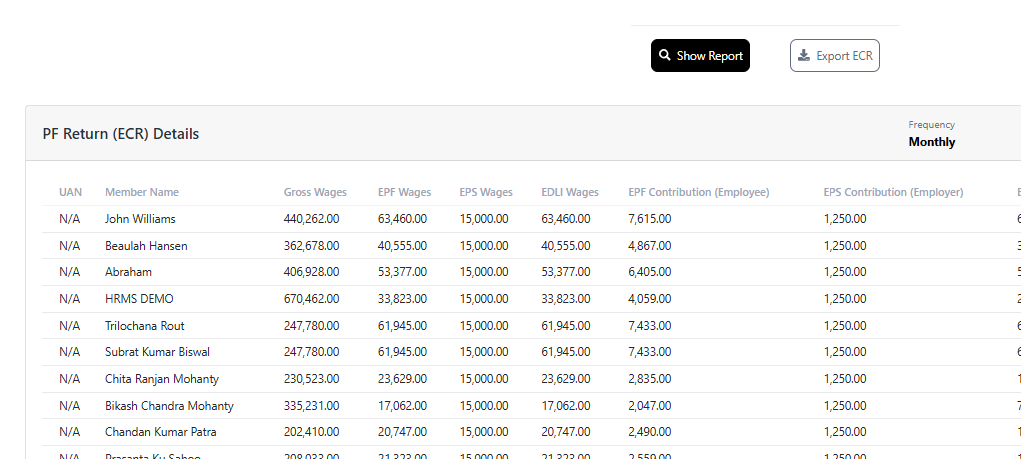

PF Return (ECR)

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on PF Return (ECR) → click on Export ECR

-

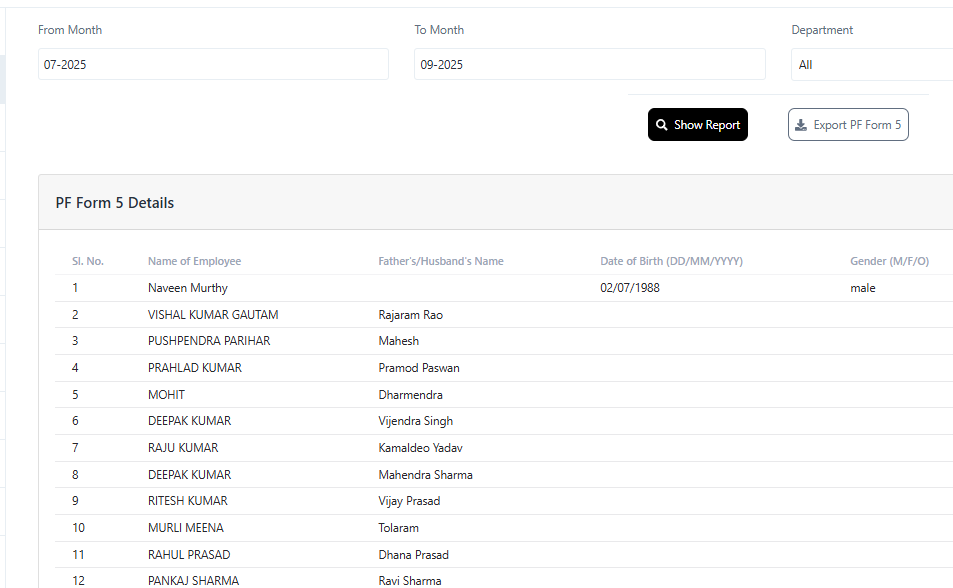

PF Form 5

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on PF Form 5 → click on Export PF Form 5

-

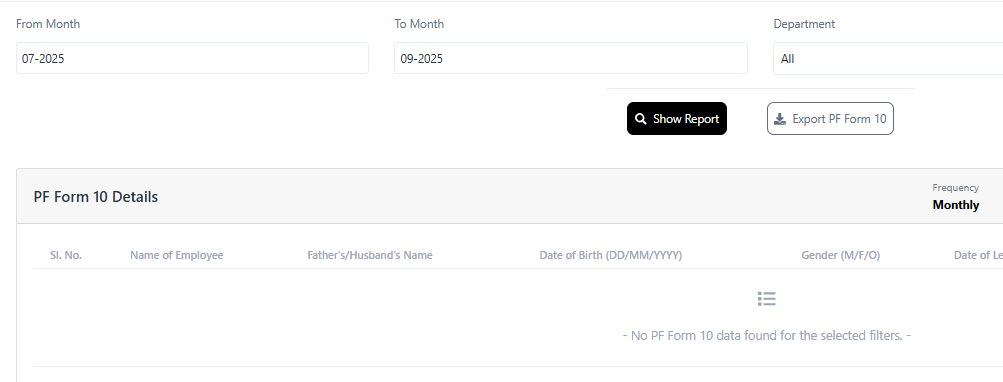

PF Form 10

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on PF Form 10 → click on Export PF Form 10

-

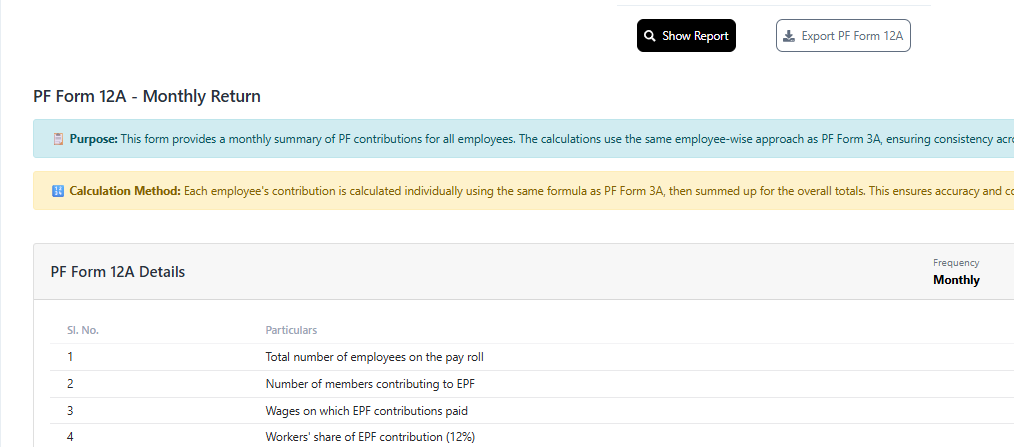

PF Form 12A

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on PF Form 12A → click on Export PF Form 12A

-

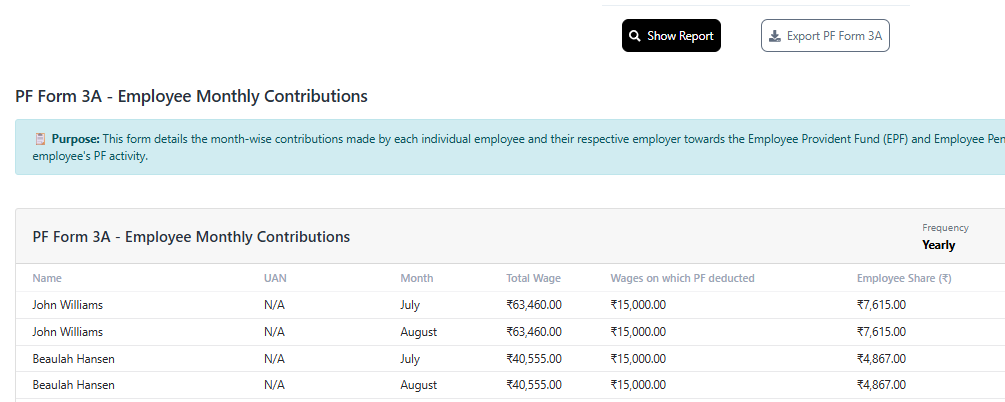

PF Form 3A (Monthly)

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on PF Form 3A (Monthly) → click on Export PF Form 3A

-

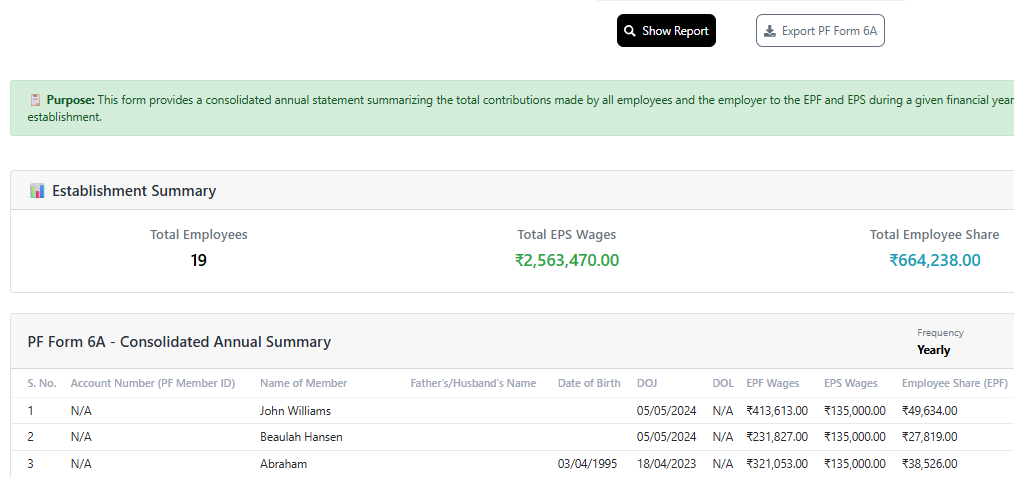

PF Form 6A (Annual)

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on PF Form 6A (Annual) → click on Export PF Form 6A

-

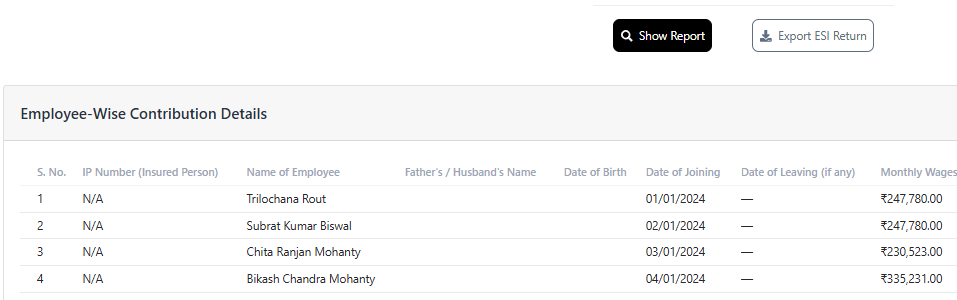

ESI Return

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on ESI Return → click on Export ESI Return

-

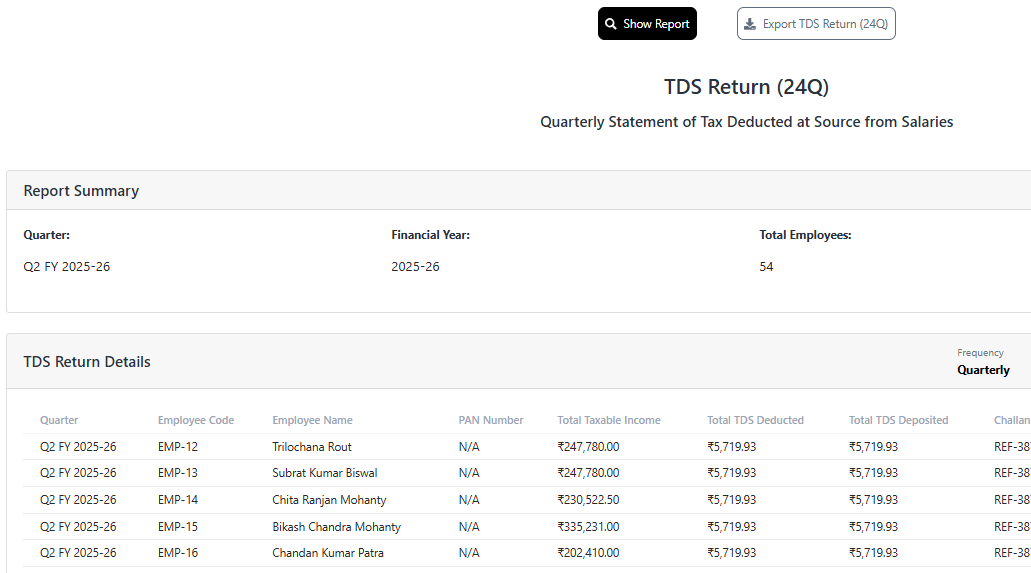

TDS Return (24Q)

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on TDS Return (24Q) → click on Export TDS Return (24Q)

-

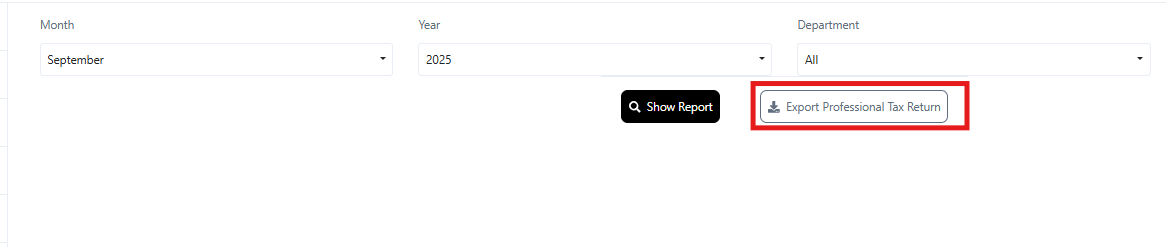

Professional Tax Return

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on Professional Tax Return → click on Export Professional Tax Return

-

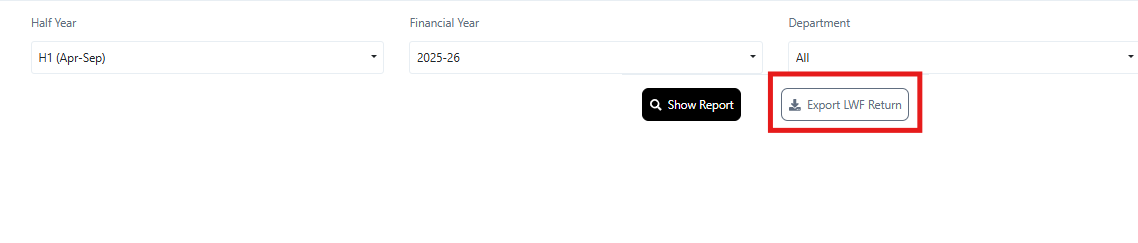

LWF Return

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on LWF Return → click on Export LWF Return

-

Government Forms

Navigate to the menu → Click HRMS → Click Statutory Filings & Returns

Navigate to the left side of Statutory Filings & Returns → click on Government Forms →View or Edit the form you need