Audits are no longer rare, reactive events. Instead, they are frequent, data-driven, and increasingly automated. Consequently, businesses that rely on spreadsheets or fragmented payroll processes expose themselves to unnecessary risk. This is exactly where payroll audit readiness becomes critical. Payroll audits do not only check salary calculations. Rather, they examine compliance, documentation accuracy, data security, tax filings, employee classification, and historical traceability.

Fortunately, modern payroll software transforms audit readiness from a stressful scramble into a continuous operational state. When implemented correctly, payroll systems ensure that every payroll cycle strengthens audit preparedness instead of weakening it.

In this guide, you will learn how payroll software supports payroll audit , what features matter most, which risks it eliminates, and how organizations can build an always-audit-ready payroll function.

What Does Payroll Audit Readiness Really Mean?

Audit readiness means your organization can confidently pass an internal, statutory, or external audit at any time — without panic, manual rework, or data reconstruction.

More importantly, payroll audit ensures that payroll data is:

- Accurate

- Complete

- Consistent

- Secure

- Fully traceable

When audit readiness is achieved, audits become verification exercises—not investigations.

Why Payroll Is One of the Highest Audit-Risk Functions

Payroll impacts every employee and touches multiple compliance layers simultaneously. As a result, auditors scrutinize payroll more closely than most operational functions.

Payroll audits typically examine:

- Salary and wage calculations

- Overtime and leave accuracy

- Tax deductions and filings

- Statutory contributions

- Employee classification

- Approval workflows

- Historical change logs

Without payroll software, maintaining payroll audit readiness across all these dimensions becomes nearly impossible at scale.

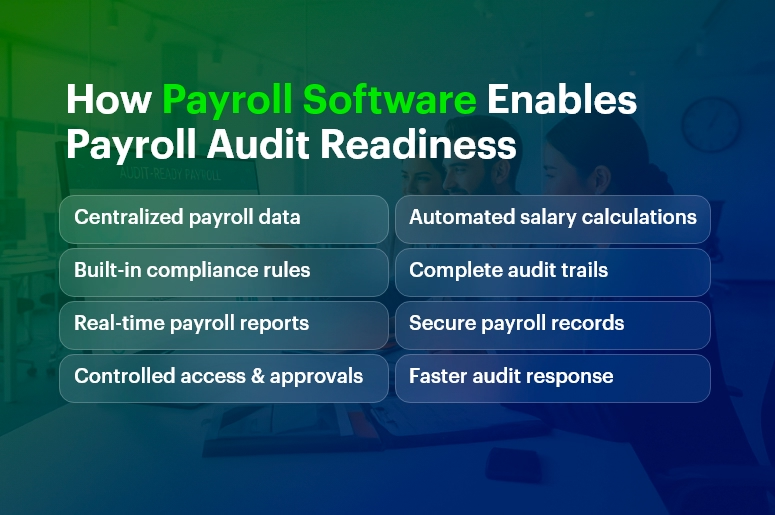

How Payroll Software Creates Continuous Payroll Audit Readiness

1. Centralized and Standardized Payroll Data

Payroll software eliminates scattered data sources. Instead of managing payroll across spreadsheets, emails, and disconnected systems, everything lives in one centralized platform.

This centralization directly improves audit readiness because:

- Data definitions remain consistent

- Records stay version-controlled

- Historical information remains intact

As a result, auditors can trace payroll data without confusion or contradiction.

2. Automated Calculations Reduce Audit Errors

Manual payroll calculations introduce risk at every step. Even small formula errors can trigger audit red flags.

Payroll software improves payroll audit by:

- Automating salary calculations

- Applying predefined compliance rules

- Eliminating manual formula dependency

Therefore, each payroll cycle reinforces accuracy rather than compounding risk.

3. Built-In Compliance Logic

Payroll regulations change frequently. Consequently, businesses that track compliance manually often fall behind.

Payroll software strengthens audit readiness by embedding compliance logic directly into payroll processing. This includes:

- Tax slabs and deductions

- Statutory contribution rules

- Filing thresholds and deadlines

As regulations evolve, systems update rules automatically—keeping audit readiness intact without constant manual intervention.

4. Complete Audit Trails and Change Logs

Auditors rarely question final numbers alone. Instead, they want to know who changed what, when, and why.

Payroll software enhances payroll audit through:

- Automatic audit trails

- Timestamped data changes

- User-level activity logs

Because of this, every payroll adjustment becomes defensible, transparent, and review-ready.

Key Payroll Software Features That Support Audit Readiness

The following features directly strengthen payroll audit readiness across organizations of all sizes:

Core Audit-Readiness Features

- Centralized employee master data

- Automated payroll calculations

- Statutory compliance automation

- Historical payroll records

- Secure data storage

Advanced Audit-Control Capabilities

- Role-based access controls

- Approval workflows

- Exception reporting

- Version tracking

- Document repositories

Together, these features convert audit readiness into an embedded capability rather than an afterthought.

Payroll Software and Documentation Readiness

Documentation is often the weakest link during payroll audits. Missing records delay audits and raise compliance concerns.

Payroll software improves audit readiness by storing:

- Payslips

- Tax filings

- Contribution reports

- Employment records

- Policy acknowledgments

Since documents remain digitally indexed and searchable, audit preparation time drops dramatically.

Real-Time Reporting for Faster Audit Response

Auditors expect immediate answers. Delays suggest weak controls—even when data is accurate.

Payroll software supports audit readiness through real-time reporting, including:

- Payroll summaries

- Tax deduction statements

- Employee-level breakdowns

- Period-wise comparisons

As a result, audit queries receive instant, evidence-backed responses.

Internal Controls Strengthened by Payroll Software

Strong internal controls are a foundation of payroll audit. Payroll software enforces controls by design rather than by discipline.

These controls include:

- Segregation of duties

- Multi-level approvals

- Restricted access to sensitive data

- Automated validations

Consequently, payroll risk decreases even before audits begin.

Payroll Software and Employee Classification Accuracy

Employee misclassification is a major audit trigger. Payroll software improves payroll audit by enforcing classification rules for:

- Full-time employees

- Contractors

- Temporary staff

- Gig workers

Because classifications directly affect taxes and benefits, automated enforcement reduces regulatory exposure significantly.

Data Security and Payroll Audit Readiness

Audits increasingly examine data security practices. Payroll software strengthens audit readiness by offering:

- Encrypted payroll data

- Controlled access permissions

- Secure backups

- Tamper-resistant logs

Thus, payroll audits now evaluate both financial accuracy and data governance—with payroll software addressing both.

How Payroll Software Reduces Audit Preparation Time

Without payroll software, audit preparation often takes weeks. With payroll software, it takes hours.

Payroll audit improves because:

- Reports generate instantly

- Documents are centrally stored

- Audit trails require no reconstruction

As a result, finance and HR teams focus on operations—not emergency compliance work.

Payroll Software and Cross-Department Audit Alignment

Audits often involve HR, finance, compliance, and leadership teams. Payroll software improves payroll audit readiness by acting as a single source of truth across departments.

This alignment eliminates conflicting reports and ensures consistent responses during audits.

Common Payroll Audit Risks Eliminated by Software

Payroll software directly reduces audit exposure by eliminating:

- Manual calculation errors

- Missing documentation

- Inconsistent data versions

- Unauthorized changes

- Compliance oversight

Therefore, audit readiness becomes proactive rather than reactive.

Who Benefits Most From Audit Readiness?

Payroll audit readiness benefits organizations across all stages:

- Startups preparing for investor due diligence

- SMEs managing regulatory expansion

- Enterprises facing frequent statutory audits

- Global teams handling complex payroll structures

In every case, payroll software scales audit readiness with business growth.

Best Practices to Maximize Audit Readiness

To fully leverage payroll software for audit readiness:

- Configure approval workflows correctly

- Maintain role-based access controls

- Review audit logs periodically

- Keep compliance settings updated

- Train teams on audit-friendly processes

These practices ensure payroll audit readiness remains continuous—not seasonal.

Final Thoughts

Payroll audits will only become more frequent and more automated. Businesses that depend on manual payroll processes will struggle to keep up.

Payroll software transforms audit readiness from a compliance burden into an operational strength. By automating accuracy, enforcing controls, and preserving transparency, payroll systems ensure organizations remain audit-ready every single day.

Ultimately, payroll audit readiness is not just about passing audits. It is about building trust, protecting the business, and enabling confident growth.